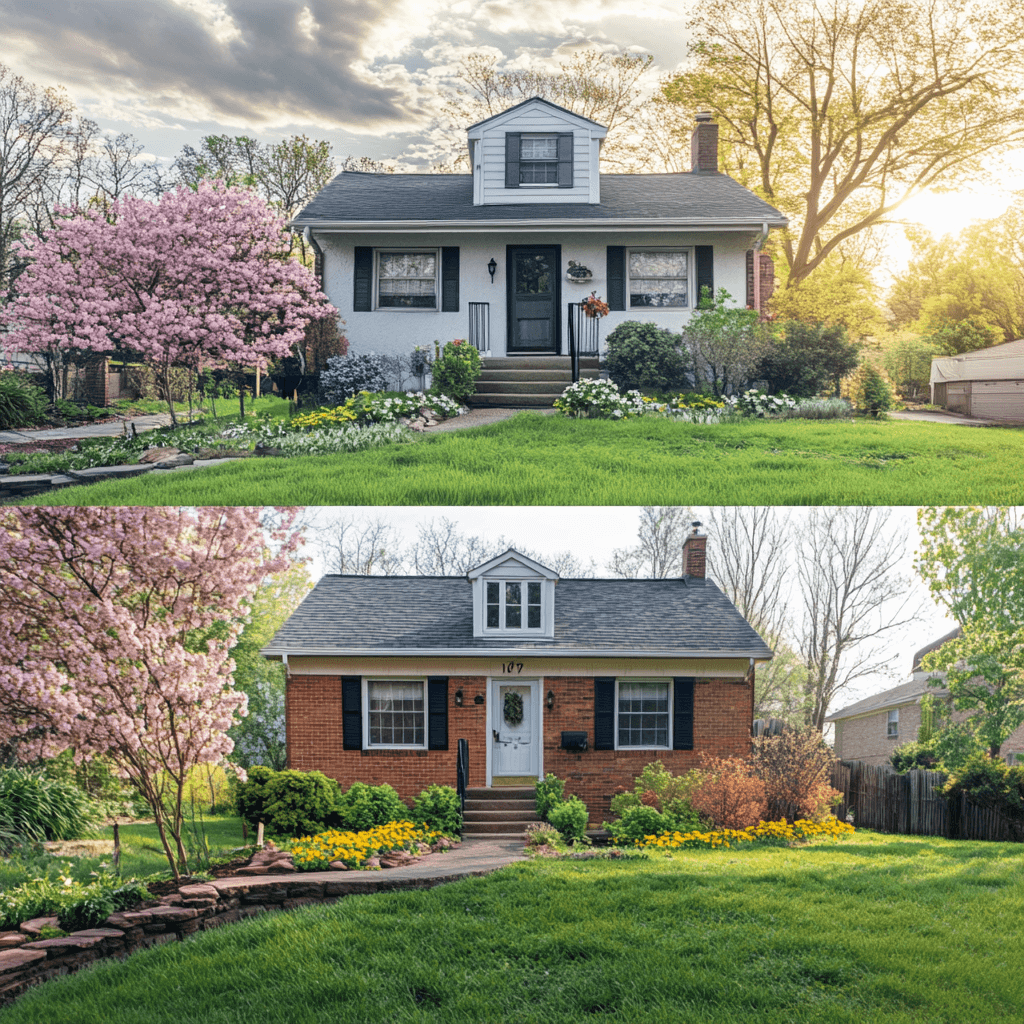

Boost Your Home's Value with a Spring Makeover

As spring breathes new life into the world around us, it's the perfect time to rejuvenate our living spaces. This article delves into how a home equity loan from a credit union can be a smart financial strategy for funding home improvements.

Understanding Home Equity Loan Options at Your Credit Union

Opting for a home equity loan through a credit union can be an excellent choice for funding spring home improvements. Generally, there are two main types of home equity loans to consider: closed-end loans and home equity lines of credit (HELOCs). Knowing the specific characteristics of each can help you make an informed decision on the most suitable option for your renovation.

Closed-End Home Equity Loans

A closed-end home equity loan provides a lump-sum payment to be repaid over a fixed term with a set interest rate. This type of loan is ideal for homeowners who have a clear understanding of their project costs and prefer the stability of predictable monthly payments. When planning a large-scale renovation, such as a kitchen remodel or a roof replacement, this type of financing ensures that you have the necessary funds upfront.

Home Equity Lines of Credit (HELOCs)

Alternatively, a HELOC operates more like a credit card, giving you a line of credit to draw from as needed, typically with a variable interest rate. This option is beneficial for ongoing or phased projects where expenses may vary over time. A HELOC offers flexibility, allowing for repeated withdrawals without reapplying for credit, which can be particularly useful if your spring home improvement projects include both indoor and outdoor upgrades.

The Credit Union Advantage

Credit unions are known for their competitive rates and personalized service when it comes to home equity loans. Members can often enjoy lower fees, reduced interest rates, and potential tax benefits, as the interest on these loans is usually tax-deductible if used for home improvements. Ensure that you consult with your credit union representative and possibly a tax advisor to understand the full benefits of your loan.

Strategizing Spring Home Improvements

Spring home improvements should not only enhance your living experience but should also add value to your home. Projects that focus on maintenance and repairs, such as fixing leaky roofs or replacing old windows, are not just cosmetic—they are essential for protecting your home's integrity and value. Using a home equity loan for these improvements ensures that your property remains in top condition.

Adding extra space, whether through building a deck or finishing a basement, can significantly improve the functionality of your home and its market value. HELOCs are particularly suitable for these types of developments as the project scope can easily change and may require additional funding.

Moreover, investing in upgrades that enhance safety and energy efficiency can save you money in the long run. Installing smart home systems for security or solar panels for green energy can be financed easily through either type of home equity loan.

Practical Tips for Home Improvement Project Planning

Assess and prioritize projects based on needs, expected value addition, and budget constraints.

Obtain detailed cost estimates from contractors or DIY research to guide your loan amount decision.

Consider the timing of your projects in relation to loan disbursement schedules, especially for HELOCs.

Stay informed about the implications of changing interest rates if opting for a HELOC.

Ensure you have a solid repayment plan in place to handle the financial responsibility of a new loan.

In conclusion, using a home equity loan from your credit union to finance your spring home improvements not only provides the monetary resources required but also adds value both personally and financially. By understanding the loan types and planning diligently, you can maximize the impact of your renovations and enjoy the rejuvenation of your home for years to come.

In conclusion, as flowers bloom and temperatures rise, spring is your chance to add value to your home with a variety of improvements. By tapping into the financial resources of a credit union through a home equity loan, you can accomplish your renovation goals. Embracing the potential of your property's equity can not only brighten your living space but also secure a financially savvy investment for the future.