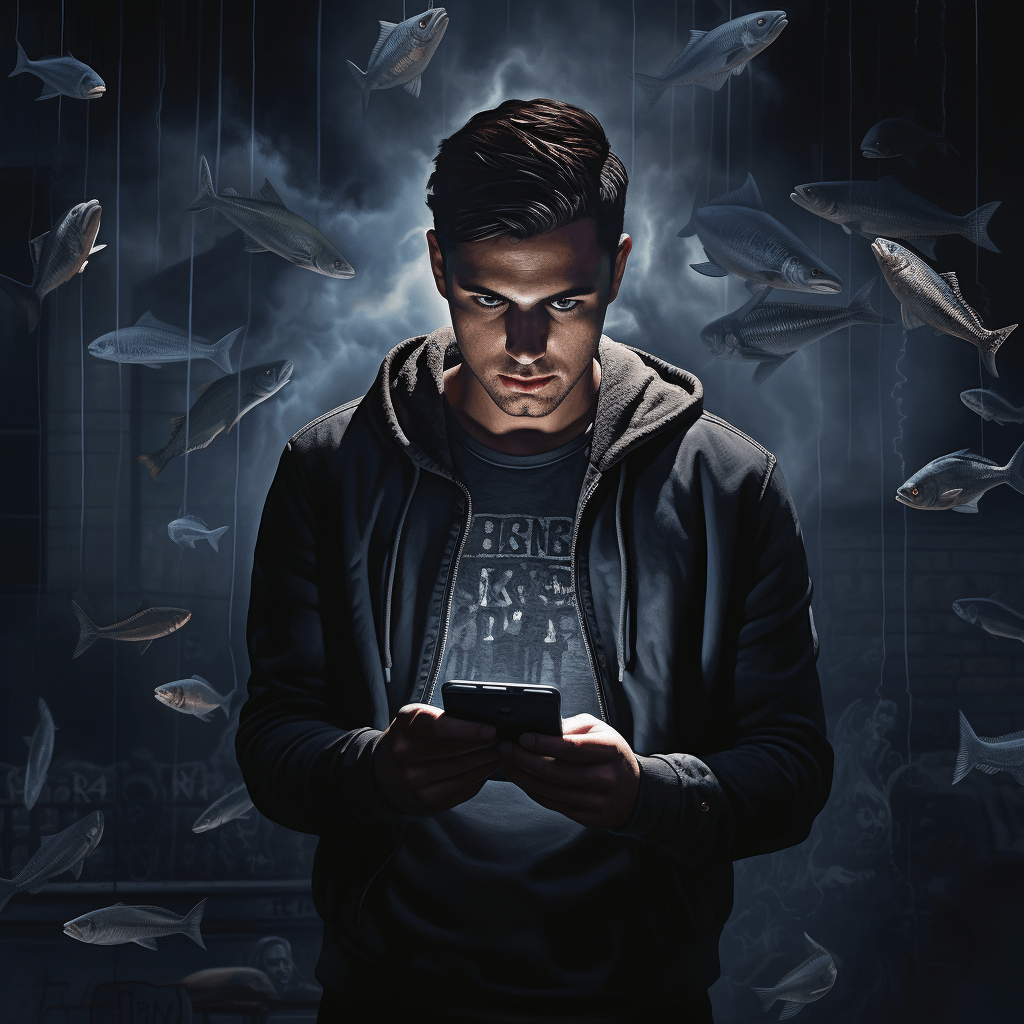

Guarding Against Fraud: Spotting an MFA Code Phisher

As multi-factor authentication (MFA) becomes a staple for securing financial operations online, fraudsters continuously devise cunning strategies to trick users into revealing their six-digit MFA codes. This article delves into the signs of such deceit and how you can protect yourself from these sophisticated phishing attempts.

Unpacking the MFA Phishing Threat

Despite the robustness of multi-factor authentication, it remains vulnerable to human error, providing an opening for fraudsters using social engineering tactics. In this chapter, we explore the techniques used by scam artists to extract these critical codes from unsuspecting individuals, emphasizing the psychological manipulation that often goes unnoticed until it's too late.

We'll discuss the common indicators of a phishing attempt, differentiating between various phishing types such as email phishing, spear phishing, whaling, and clone phishing. This deep dive inspects each method's intricacies and how they might be applied specifically to procure MFA codes.

Understanding the weaknesses in personal security practices—an all too human factor—that these criminals exploit is vital. We'll arm readers with knowledge on the types of messages or calls that should raise alarm bells, how to recognize fake versus genuine communication, and the proper steps to take if one encounters a suspected MFA phishing attempt.

Identifying a Potential MFA Phishing Scam

The first red flag of a phishing attempt designed to steal your MFA code is often the sense of urgency. Fraudsters create a false sense of immediacy to prompt quick, thoughtless action. Look out for messages pressing you to act immediately to avoid negative consequences such as account closure or legal action. This tactic relies on your emotional response, hoping you'll comply before critically appraising the situation.

An additional sign of phishing is the use of suspicious sender addresses. In email-based scams, the email might look similar to a legitimate institution's address but with subtle discrepancies. Close inspection might reveal unfamiliar or misspelt domain names which are tell-tale signs of foul play.

Spear phishing, a more targeted form of phishing, may use personal information to convince you of its legitimacy. This could be data gathered from social media or leaked through data breaches. In such attempts, the message's content may reference things that only someone who seemingly has legitimate access to your information could know. However, this is a ruse designed to catch you off-guard.

Whaling attacks go after high-profile targets. These often involve crafted messages that appear to come from high-ranking officials within an organization, requesting MFA codes to address a purportedly critical issue.

Clone phishing involves the replication of a legitimate message with authentic-looking logos, text, and signatures, but with malicious links or attachments. It may even copy a genuine message you've previously received, such as a password reset email, but it will direct you to a fraudulent site where your MFA codes can be intercepted.

Spotting the Hallmarks of Fraudulent Communication

Another key aspect of identifying MFA phishing is the language used in the suspicious communication. Watch for alarmist language, grammatical errors, or unusual phrasing. Legitimate institutions typically avoid scare tactics and maintain a professional tone in their communication. Any deviation from this standard may indicate a scam.

Beware of clickable links or requests for personal information. Financial institutions will not ask for your MFA code over email or text message as part of standard protocol. Instead, they usually ask you to enter it directly into their secured website or app during your login session. Any direct request for sensitive information should immediately raise concerns.

If you receive an unsolicited phone call from someone claiming to be from your financial institution and they ask for your MFA code, this is a significant red flag. Genuine representatives would not request this information over a call. Instead, they will guide you through the secure process which does not involve revealing your MFA code.

A sense of urgency to act quickly

Emails with suspicious or slightly altered sender addresses

Messages with personal information to feign legitimacy (Spear phishing)

Requests seemingly from high-ranking individuals (Whaling)

Authentic-looking, but fraudulent duplicates of legitimate messages (Clone phishing)

Communication using alarmist language or scare tactics

Grammatical errors or odd phrasing

Requests for sensitive info through insecure channels

Unsolicited phone calls asking for MFA codes

To further protect oneself from falling victim to MFA phishing, it is advisable to familiarize yourself with how your financial institution communicates with you and how they handle multi-factor authentication procedures. This way, you are better equipped to spot anomalies in their communication protocols, making you less susceptible to these forms of social engineering attacks. Should you come across suspected MFA phishing attempts, the best course of action is to contact your financial institution immediately through verified contact details, rather than through the information provided in the suspicious message or call.

Awareness is the key to defending against MFA phishing frauds. By recognizing the tactics used by fraudsters, such as spear phishing and social engineering, you can avoid falling prey to scams that target your financial security. Stay vigilant, question unusual requests for your MFA codes, and remember to never share your authentication details.